Decision-makers in fast-moving markets need accurate and up-to-date information to act with confidence. Where can you buy access to real-time cryptocurrency market data? This guide highlights five premium platforms that stand out for professionals.

Real-time crypto market data gives precise prices, volumes, and context for operations like treasury hedging and competitive analysis. Each option here offers depth, reliability and tools that make it easy to turn raw data into usable insight with minimal to zero roadblocks.

Table of Contents

Amberdata — The Institutional Standard for Digital Assets

Amberdata is designed to serve financial institutions, asset managers and enterprise-grade financial applications. Users get granular, full-fidelity trade, and order book data from major venues and on-chain data across leading networks, all delivered through a unified interface. For busy teams, this means less vendor wrangling, fewer data joins, and a clearer path from collection to analysis.

What sets Amberdata apart is convenience without sacrificing rigor. Its unified API spans market and on-chain domains so users can stitch together exchange liquidity, derivatives flow, stablecoin movements, and wallet activity in one place. Teams that need verification get access to reference rates and benchmark methodologies that adhere to best practices. If real-time crypto market data is a priority, Amberdata’s stack is built to deliver it with context.

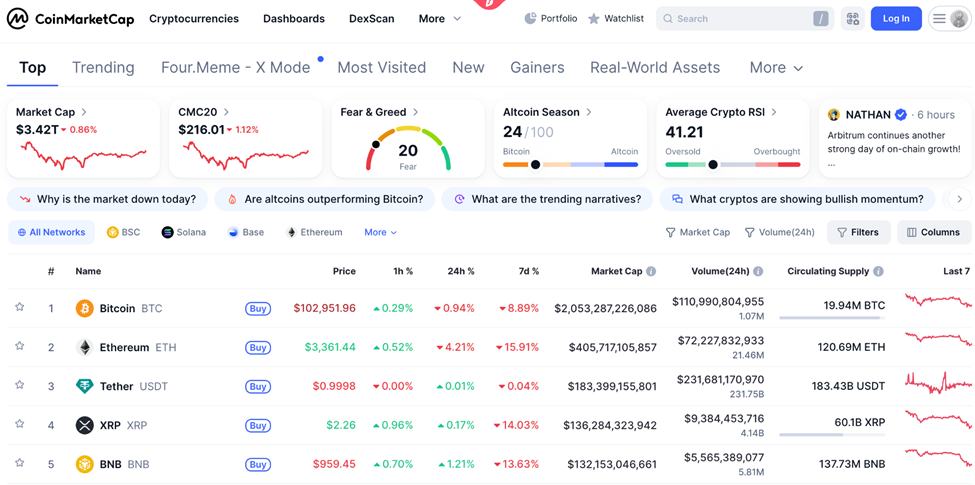

CoinMarketCap — The Industry’s Most Recognized Name

CoinMarketCap is arguably the most widely recognized source for crypto information. For many users, it serves as a first stop when learning about the sector. It gives a broad overview of prices, market capitalization and trading volumes for thousands of assets on hundreds of exchanges.

Although known for its free, consumer-facing website, CoinMarketCap has a strong professional API that large crypto exchanges and banks use. It offers comprehensive access, custom call limits and detailed historical data, enabling businesses to build accurate charts or backtest strategies. For product managers who need a quick sense of market breadth and rankings, its interface and asset pages are easy starting points.

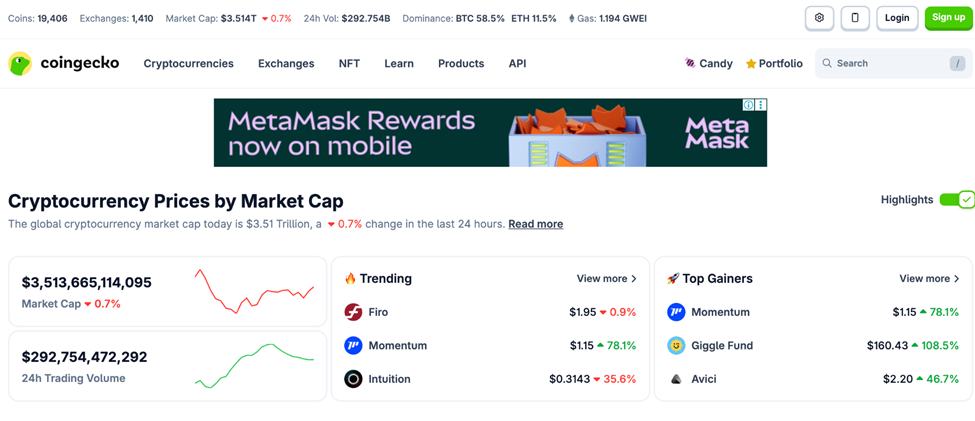

CoinGecko — The Community-Driven Aggregator

CoinGecko is known as an independent aggregator with deep coverage of decentralized finance and non-fungible token categories. Its public materials highlight fundamentals beyond price, including developer activity and community metrics, which can be helpful for early-stage diligence.

CoinGecko’s API is great for developers who need quick prototypes or work on projects with tight budgets. Its free tier lowers the barrier to integrating live feeds, while its paid plans scale for heavier use. The platform also provides a holistic view of projects by including developer and social statistics, offering more than just price data.

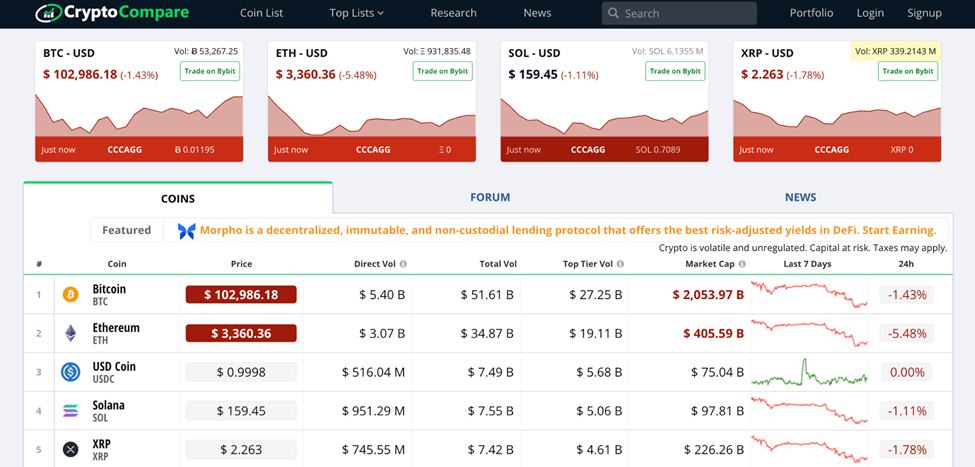

CryptoCompare — Granular Data for In-Depth Analysis

CryptoCompare is known for its granular, real-time, and historical coverage. In a 24/7 market with hundreds of exchanges, it solves a critical problem regarding the “real” price of an asset. The platform’s core differentiator is its regulated, proprietary aggregate index, the CCCAGG. It collects tick-level trade data from over 300 exchanges and uses this data to produce a volume-weighted average price for digital assets.

The dataset extends into order books and derived analytics, which matters to those modeling slippage, testing execution logic or studying microstructure. Teams doing market research will find that depth helpful for building realistic simulations and evaluating venue quality and liquidity fragmentation across regions.

Glassnode — The Premier On-Chain Intelligence Platform

Glassnode operates in a distinct category — it’s not a market data aggregator but a specialized on-chain intelligence platform that provides insights taken from blockchain networks. While other platforms give the price of an asset, this option helps users understand why the price is moving by looking at the market’s fundamental drivers.

Its analytics suite is built for charting, exploring and exporting on-chain series, making it convenient for users to test narratives, document theses and back decisions with quantifiable network data. Many professionals combine Glassnode with a market aggregator to get a more complete picture of flows, supply dynamics, and risk.

Top Crypto Data Providers At a Glance

Here is a quick comparison of the top five providers based on role and access model.

| Provider | Primary Focus | Free Tier Availability |

| Amberdata | Institutional data infrastructure | None, has plans for startups and enterprises |

| CoinMarketCap | Broad market aggregation | Yes, with limitations |

| CoinGecko | Independent, community-driven aggregation | Yes, generous free tier |

| CryptoCompare | Granular data and pricing indices | Yes, for personal use |

| Glassnode | On-chain intelligence and analytics | Yes, with limited data |

Methodology

The platforms in this list were selected to meet a professional standard. They provide institutional-level data quality, a single and well-documented application programming interface (API) access, extensive market and on-chain coverage, deep historical datasets for research and backtesting, and a strong industry reputation that major financial institutions and fintech applications trust.

Key Features to Look For in Crypto Market Platforms

Before buying access to real-time cryptocurrency market data, ensure the features match your needs. Here are the ones that matter most.

Comprehensive Market and On-Chain Coverage

Exchange trades show where deals happen, while on-chain data demonstrates how assets move, who is buying them and where imbalances are building. Combining these helps users catch shifts sooner, monitor liquidity migration across venues and validate whether price action has network support.

Real-Time Data and Low Latency

In a volatile, 24/7 market, the goal is to have low latency — the shortest possible delay between a market event and the data arriving in the system. High latency is risky for a business because prices can fluctuate in milliseconds, and delays can impact finances and damage client trust.

Powerful API Access and Developer Tools

A flexible, well-documented API accelerates integration into research notebooks, dashboards and risk systems. It allows for the automation of trade or accounting processes, gives customer-facing apps access to real-time data, and grows with the business. Building this technology from scratch takes a lot of time and money, so a premium API is a cost-effective way to focus on core offerings and get to market faster.

Strong Historical Data for Backtesting

Backtesting — the process of using historical data to simulate how a hypothesis would have performed in the past — is only as good as the history behind it. However, using simplified data can create an illusion of profitability. This is why professional platforms should allow users access to detailed, granular data that lets them backtest by mimicking real-world situations like liquidity gaps and slippage. Doing so is the best way to validate a strategy before risking capital.

Choosing the Best-Fit Platform

The providers highlighted in this guide represent best-in-class solutions, but they serve different needs. The “best” choice depends on your goals, whether you’re building institutional infrastructure, conducting fundamental research or powering a new application. As digital assets mature, real-time cryptocurrency market data and high-quality analytics will keep separating informed operators from reactive ones. Explore the platform that aligns with your goals, stacks the right features and builds your edge.