PayManager2 Raj Nic In Main Asp

If you’ve landed here searching for paymanager2 raj nic in main asp, you’re probably a government employee in Rajasthan trying to access your salary slip or manage your payment details. I get it—navigating government portals can feel like solving a puzzle sometimes. But don’t worry, I’m going to walk you through everything you need to know about this essential portal that handles salary management for thousands of Rajasthan government employees.

The PayManager system is basically the digital backbone of salary distribution for state government workers. Whether you’re trying to download your pay slip, check your bank account details, or generate a salary bill, this portal does it all. Let me break down how this system works and how you can make the most of it without pulling your hair out.

Table of Contents

What is PayManager?

The Rajasthan Pay Manager portal is a pay bill preparation system for government employees in Rajasthan. The portal provides a common and promotional platform for preparing employee pay bills. This software not only allows for salary bill preparation, but also allows for DA arrears, bonus arrears, and leave encashment bills.

| Portal Name | PayManager |

| Launched By | Rajasthan Government |

| Related Department | Finance Department, Government of Rajasthan |

| Beneficiaries | All Government Employees of Rajasthan |

| Objective | To offer online salary services for Rajasthan government employees |

| Official Website | paymanager.rajasthan.gov.in |

| Helpline No. | 0141-5111010 || 0141-5111007 |

| Email ID | paymanagerrj@gmail.com |

Objective of starting Pay Manager

The Rajasthan government’s objective in launching this portal is to provide better online payroll services to all government employees in the state. Using this portal, all government employees in Rajasthan can easily view and download their payslips. Furthermore, they can take advantage of a variety of features.

What are the features of Pay Manager Portal? | Feature of Pay Manager Rajasthan Portal

PayManager offers a number of features to make salary management for government employees seamless and easy. Its key features include:

1. Employee Salary Processing: PayManager automates salary calculations, including allowances, deductions, and net pay distribution.

2. Payslip Generation: Employees can view and download their monthly payslips directly from the portal.

3. Income Tax Calculation: The system helps calculate tax deductions based on the salary structure.

4. Loan and Advance Management: Manages employee loan and advance information and adjusts deductions accordingly.

5. GPF and NPS Contributions: Tracks government employees’ General Provident Fund (GPF) and National Pension Scheme (NPS) contributions.

6. DA Arrears Calculation: The software efficiently calculates dearness allowance (DA) arrears.

7. Bill Preparation: It helps prepare pay bills and other financial statements required for government records.

8. Online Bank Statement Update: Employees can update their bank statements securely through the system.

9. Name and Date of Birth Correction: Employees can request corrections to personal information such as name and date of birth.

10. Digital Signature Installation: Ensures secure authentication through digital signatures and necessary settings.

What work is done by PayManager DDO?

- Through Pay Manager Portal, Drawing and Disbursing Officer (DDO Officer) can generate Salary Bill, DA Arrears, Salary Arrears Bill, Leave Encashment Retirement Bill and many more.

- Using this, government employees can easily view their salary slips and also get information related to allowances, tax deductions and pension.

- It is also used for salary bills, travel expenses bills, dearness allowance bills, PL encashment bills, bonus bills, arrears bills etc.

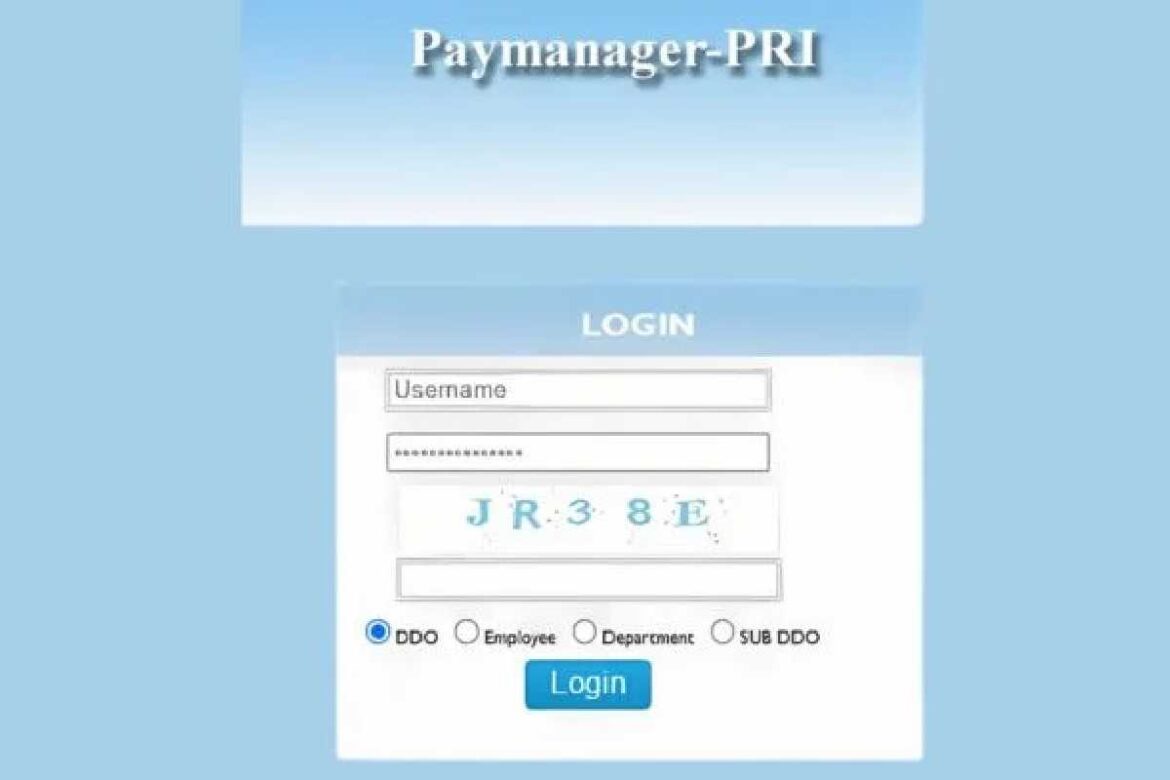

How to login to Paymanager DDO Portal?

- To login to Rajasthan Paymanager Portal, first of all you have to visit its official website, which is https://paymanager.rajasthan.gov.in/.

- After this you have to choose your option from all the given options (DDO, Employee, Digital, Department, Sub DDO, HOD/Sub HOD).

- After selecting your option you will need to enter your username and password.

- After filling both these things, you will have to fill the captcha code and then you can click on the login button.

To use PayManager?

- Visit the official Pay-Manager portal.

- Login to your Paymanger account.

- Go to the Salary section. View your monthly salary, allowances, and deductions. Download your payslip if desired .

- View and download Income Tax and GPF/NPS details.

- DDO and Admin users can generate salary bills and process payments for employees.

- Employees can securely update their bank details.

- Employees can make corrections to their personal information.

How to change PayManager password?

You will receive periodic messages asking you to change your Rajasthan Pay Manager Portal password. You can also change your password by visiting its official website .

- To change its password, first of all you have to go to its official website, which is https://paymanagerddo.rajasthan.gov.in/.

- After this you will see the option of Forgot Password.

- By clicking on that option, you will reach a new page where you will get the password reset form.

- After filling all the information given on that form, you will have to enter the mobile number and receive the OTP and fill it in.

- After this you will have to submit it, after which you can change your password.

How to download Salary Slip from PayManager?

If you want to download Salary Slip from Pay-Manager Rajasthan, then follow the easy steps given below:

Steps 1. First of all go to the official website of PayManager paymanager.raj.nic.in .

Steps 2. Login by entering your User Name , Password and Capture Code on the home page . Steps 3. After login a new interface will open. Here click on the “Employee Report” option given on the left side. Steps 4. Now select the “Pay Slip (Monthwise)” option from the dropdown menu. Steps 5. On the next page select the month , year , and financial year. Steps 6. Then click on the submit button.

Understanding Paymanager2 Raj Nic In Main Asp Portal

The specific URL paymanager2 raj nic in main asp refers to the main access point of the PayManager portal. The “raj nic in” part tells you it’s hosted on Rajasthan’s National Informatics Centre server, while “main asp” indicates the primary ASP (Active Server Pages) based application.

When you type this address into your browser, you’ll land on the login page where you need your credentials to access your personal salary information. The system uses secure authentication to protect your financial data. Each employee gets a unique login ID and password that’s linked to their employee code.

The portal gets updated regularly with new features. The latest version, often called IFMS 3.0, comes with improved security and better navigation. If you’re accessing the site for the first time, you might need to register using your employee ID and some basic verification details. Your department’s DDO (Drawing and Disbursing Officer) usually helps with the initial setup.

How To Access Paymanager2 Raj Nic In Main Asp Login

Getting into your PayManager account is straightforward once you know the steps. Here’s what you need to do:

Visit the Official Portal: Open your browser and navigate to the PayManager Rajasthan website. Make sure you’re on the genuine government site—check for the “.nic.in” domain to avoid phishing sites.

Enter Your Credentials: You’ll need your employee ID, password, and sometimes a captcha code. Your employee ID is the unique number assigned to you when you joined government service. If this is your first time logging in, you might be using a default password provided by your office.

Select Your Role: The portal has different access levels. As an employee, you’ll select the “Employee” option. DDOs and other administrators have separate login sections with additional permissions.

What To Do If Login Fails – PayManager2 Raj Nic In Main Asp

Sometimes the portal gets heavy traffic, especially around salary disbursement dates. If you can’t log in, wait a few minutes and try again. Clear your browser cache and cookies—this fixes most technical glitches. Make sure your internet connection is stable because the session can time out if your connection drops.

If you’ve forgotten your password, there’s a password recovery option. You’ll need your registered mobile number or email address. The system sends you a reset link that’s valid for a limited time. For serious issues, contact your DDO or the PayManager helpdesk.

Mobile Access and Browser Compatibility

The PayManager portal works best on desktop browsers like Chrome, Firefox, or Edge. Mobile browsing is possible but not always smooth for all features. If you’re using a phone, switch to desktop mode in your browser settings for better functionality. The government is working on a dedicated mobile app, but for now, the web portal is your best bet.

What Is a Salary Slip PDF and Why You Need It

A salary slip is basically your monthly payment receipt from the government. It’s a detailed document that shows your basic pay, allowances, deductions, and net salary. The <strong>paymanager2 raj nic in main asp salary slip comes in PDF format, which you can download and save on your device.

This document is crucial for several reasons. Banks ask for salary slips when you apply for loans or credit cards. Landlords might want to see them as proof of income. You’ll need them for income tax filing, visa applications, and pretty much any financial transaction that requires income verification.

Your salary slip contains important information like your employee code, designation, department name, and treasury details. It breaks down every rupee you earn—from your basic pay and grade pay to HRA (House Rent Allowance), DA (Dearness Allowance), and other benefits. The deduction section shows PF contributions, professional tax, income tax, and any loan repayments.

Components of a Government Salary Slip

The top section has your personal and employment details. Then comes the earnings section listing all components of your salary. Basic pay forms the foundation—everything else gets calculated based on this amount. Grade pay (which we’ll discuss separately) adds to your basic pay for certain purposes.

Allowances make up a significant chunk of your take-home. HRA depends on your posting location—metro cities get higher rates. DA gets revised twice a year based on inflation. Transport allowance, medical allowance, and special allowances vary by department and position.

Deductions come next. Mandatory deductions like GPF (General Provident Fund) or NPS (New Pension Scheme) help build your retirement corpus. Tax deductions follow Income Tax rules. Professional tax is a state levy. Some employees have additional deductions for housing loans, vehicle loans, or society dues.

How To Read Your Salary Slip Correctly

The gross salary is the total of all your earnings before any deductions. Net salary is what actually lands in your bank account—gross salary minus all deductions. Always verify that your bank account number on the slip matches your actual account. Mistakes here can delay your salary.

Check the payment date and month carefully. Sometimes there are arrears from previous months or recoveries that need explaining. If you see unexpected deductions or amounts that don’t make sense, reach out to your accounts section immediately. Don’t wait until the problem compounds over several months.

Downloading Your Paymanager Salary Slip

Getting your paymanager salary slip download is a simple process once you’re logged in. After successful login, look for the “Employee” or “Employee Report” section in the main menu. You’ll find various options related to your salary information.

Click on “Salary Slip” or “Pay Slip” option. A new page opens where you need to select the month and year for which you want the slip. Choose the financial year first, then the specific month. The system stores slips for several years, so you can access historical data too.

Hit the “Search” or “Generate” button. The system processes your request and displays your salary slip on screen. At this point, you’ll see a “Download PDF” or “Print” button. Click it to save the PDF file to your computer. The file usually downloads to your default downloads folder.

Saving and Organizing Your Salary Slips

Create a dedicated folder on your computer or cloud storage for salary slips. Name your files systematically—something like “SalarySlip_Month_Year.pdf” makes them easy to find later. I recommend keeping at least three years of slips readily accessible since you never know when you’ll need them.

Some people prefer printing physical copies and maintaining a file. That’s fine, but digital copies are more practical. They don’t take up space, can’t get damaged, and are easy to email when needed. Just make sure you have backups—use Google Drive, Dropbox, or an external hard drive.

If the PDF doesn’t download or shows an error, try a different browser. Sometimes browser security settings block downloads. You can also try right-clicking the download button and selecting “Save link as.” Check that your PDF reader is updated—outdated software can cause viewing problems.

Troubleshooting Download Issues

The portal sometimes experiences server issues during peak hours. Early morning or late evening usually work better for downloads. If you’re getting a blank PDF or corrupted file, clear your browser cache and try again. Disable browser extensions temporarily—ad blockers or security plugins sometimes interfere with downloads.

Make sure JavaScript is enabled in your browser settings. The PayManager portal uses JavaScript for many functions, and disabling it causes problems. If you’re on a restricted office network, firewall settings might block certain features. Try accessing from home or use a different network.

Understanding Grade Pay in Rajasthan Government

The question “what is the salary of 5400 grade pay in Rajasthan?” comes up often. Grade pay is an additional component added to your basic pay to determine your overall pay scale. It’s part of the Sixth Pay Commission structure that was implemented for government employees.

Grade pay of 5400 typically corresponds to middle to senior-level positions. Your actual monthly salary depends on multiple factors beyond just grade pay. The basic pay varies based on your pay band level, years of service, and increments earned. Someone with 5400 grade pay might have a basic pay ranging from 25,000 to 50,000 or more, depending on their experience.

To calculate the approximate salary, you add the basic pay plus grade pay, then add various allowances. DA currently stands at around 50% of basic pay (though this changes). HRA ranges from 9% to 27% depending on city classification. Other allowances add further to the total. After deductions for PF, tax, and other items, the net salary varies significantly.

Pay Band and Grade Pay System – PayManager2 Raj Nic In Main Asp

The pay band system groups government jobs into different levels. Each level has a minimum and maximum basic pay range. Within this range, your pay increases with annual increments and promotions. Grade pay helps determine your exact position within the hierarchy.

For example, PB-2 (Pay Band 2) ranges from 9,300 to 34,800, with different grade pays like 4200, 4600, 4800, and 5400. Higher grade pay means higher overall compensation and better benefits. It also affects your pension calculations after retirement.

The Seventh Pay Commission changed this structure, introducing pay levels instead of grade pay. However, many employees still refer to the old grade pay system when discussing salaries. Rajasthan government employees transitioned to the new system, but understanding both systems helps when comparing positions or calculating arrears.

Creating a Salary Bill on PayManager

Learning how to make a salary bill on PayManager is essential if you’re a DDO or handle salary processing for your department. The salary bill is the official document that authorizes payment to employees. It contains details of all employees under a particular DDO and their monthly salary breakup.

Log in using your DDO credentials—these are different from regular employee login details. Navigate to the “Bill Preparation” or “Salary Bill” section. You’ll see options for creating a new bill, modifying existing bills, or viewing submitted bills.

Select “New Bill” and choose the month and year. The system pulls up the list of employees under your jurisdiction. Review each employee’s details carefully. Check for any changes—new joinings, retirements, transfers, or promotions. Update employee data if needed before generating the bill.

Steps in Bill Generation Process

Enter or verify allowances for each employee. Some allowances get calculated automatically based on rules set in the system. Others might need manual entry, especially special allowances or variable components. Double-check amounts to avoid payment errors that create problems later.

Add any arrears or recoveries. Arrears are pending payments from previous months that need to be cleared. Recoveries might be for excess payments, loans, or other deductions. Document the reason for each entry clearly—the audit department reviews these later.

Generate the bill once all details are correct. The system creates a digital bill with a unique bill number. Review the generated bill carefully. Check total amounts, individual salaries, and deductions. Any mistakes caught at this stage save major headaches down the line.

Submitting and Tracking Bills

After final verification, digitally sign the bill using your credentials. The bill then moves to the treasury for approval and payment processing. You can track bill status through the portal. Statuses include submitted, under verification, approved, or rejected.

If a bill gets rejected, the system shows the reason. Common rejection causes include data mismatches, insufficient budget allocation, or documentation errors. Correct the issues and resubmit. Maintain communication with the treasury office to resolve problems quickly.

Keep records of all bills generated. The system stores historical data, but maintaining your own backup helps during audits. Export bill summaries regularly for departmental records. This practice ensures smooth coordination between your office, the finance department, and employees.

Getting Pay Slips for Government Employees

The process for how to get pay slip of government employee varies slightly depending on your designation and department. Regular employees access slips through their personal login on the PayManager portal. The steps I mentioned earlier for downloading salary slips apply to most government workers in Rajasthan.

If you’re unable to access the portal yourself, your office DDO can generate and provide your salary slip. Visit your accounts section with your employee ID. They can pull up your details and print your slip. This is common for employees who aren’t comfortable with technology or don’t have regular internet access.

Some departments send salary slips via email to registered email addresses. Check your official email around salary disbursement dates. The slip comes as an attachment, usually password-protected. The password is typically your date of birth or employee ID—check with your office for the specific format.

Alternative Methods to Access Salary Information

Retired employees or those who’ve left service can still access historical salary data. Log in using your old credentials if they’re still active. Otherwise, submit a written application to your last posting office requesting salary slips. Include details like your employee ID, period for which you need slips, and reason for the request.

For loan applications or urgent needs, some banks accept salary credit statements from your bank instead of official salary slips. This shows your monthly salary deposits and might suffice for certain purposes. However, official salary slips remain the gold standard for most transactions.

If you’re facing persistent technical issues accessing the portal, contact the PayManager helpdesk. They have dedicated support staff who can guide you through the process or escalate technical problems. Keep your employee details handy when calling—they’ll need to verify your identity.

SDM Salary Structure in Rajasthan

The question “what is the salary of SDM in Rajasthan?” interests many aspiring civil servants. SDM (Sub-Divisional Magistrate) is a prestigious position in the Rajasthan Administrative Service (RAS). The salary is quite attractive, reflecting the responsibility and authority that comes with the post.

An SDM in Rajasthan typically falls under Pay Level 11 as per the Seventh Pay Commission. The basic pay starts around 67,700 rupees and can go up to 2,08,700 with increments over the years. This is just the basic component—the actual take-home is significantly higher when you add allowances.

DA adds approximately 50% to the basic pay (current rate, subject to revision). HRA varies from 9% to 27% based on posting location. Metro and larger cities offer higher HRA. Transport allowance, additional allowances for difficult postings, and other benefits further increase the total compensation. An SDM with a few years of service easily takes home 1.5 to 2 lakh rupees monthly.

Additional Benefits for SDM Officers

Beyond salary, SDMs enjoy substantial perks. Government accommodation is provided, or HRA is paid if official housing isn’t available. They get official vehicles with fuel and maintenance covered. Medical facilities for the officer and family come free through government hospitals and dispensaries.

The position also qualifies for substantial leave travel allowance (LTA) and other welfare benefits. Pension benefits under the new system ensure financial security after retirement. The total compensation package, including monetary and non-monetary benefits, makes it one of the most sought-after positions in state civil services.

Career progression is another advantage. SDMs can get promoted to ADM (Additional District Magistrate) and eventually District Collector positions. Each promotion brings significant salary increases and enhanced allowances. The experience gained in administration, law and order, and public welfare opens doors to diverse career opportunities within government service.

PayManager Rajasthan Employee Login Portal Features

The PayManager Rajasthan employee salary slip and login portal offers multiple features beyond just downloading salary slips. Understanding all available options helps you manage your financial information better. The portal essentially serves as your complete employee service record in digital form.

After logging into <strong>paymanager2 raj nic in main asp login, you’ll find a dashboard showing your basic information. This includes your name, designation, department, office address, and current posting details. Your employee code and bank account information are displayed here. Always verify these details are current and accurate.

The “Employee Reports” section contains various report options. Salary slip is the most commonly used, but you can also generate salary certificate, bank details certificate, and GPF statement. These documents are useful for different official and personal purposes. Some banks and institutions accept these system-generated certificates directly.

Managing Personal Information – PayManager2 Raj Nic In Main Asp

The portal allows limited editing of personal information. You can update your mobile number, email address, and sometimes bank account details. However, major changes like name corrections or date of birth updates require going through proper channels with supporting documents. The DDO needs to approve most changes before they reflect in the system.

Check your leave account through the portal. Some versions show your leave balance, earned leave, casual leave, and medical leave separately. This helps in planning time off and ensuring you don’t lose accumulated leave. If your portal version doesn’t show leaves, your office maintains this separately.

Income tax-related information appears in dedicated sections during tax filing season. Form 16 details, TDS certificates, and annual tax statements get generated through PayManager. Download these documents before the deadline since they’re crucial for filing your income tax returns correctly. Keep both digital and physical copies safe.

Arrears and Bonus Tracking

When the government announces arrears, DA revisions, or bonuses, these amounts get processed through PayManager. You can track these special payments separately from regular salary. The system shows payment status, amount sanctioned, and disbursement date. This transparency helps employees know exactly when to expect these additional payments.

GPF and NPS subscribers can track their contributions and accumulations. The portal shows monthly contributions, interest earned, and current balance. This information is valuable for retirement planning. Cross-verify with your annual GPF statement to ensure all contributions are properly credited.

IFMS 3.0 PayManager Salary Slip System

The IFMS 3.0 paymanager salary slip system represents the latest upgrade to the financial management infrastructure. IFMS stands for Integrated Financial Management System, and version 3.0 brings enhanced features and better integration across departments. This upgrade aims to make salary processing more efficient and transparent.

The new system has improved security features. Multi-factor authentication protects against unauthorized access. Data encryption ensures your financial information remains confidential. The system logs all access attempts and downloads, maintaining an audit trail for security purposes.

Navigation got easier with IFMS 3.0. The interface is more intuitive, with clearly labeled sections and improved search functionality. Loading times decreased, and the system handles higher traffic better. These improvements mean fewer frustrations when accessing your information during peak times.

Enhanced Features in New Version

Real-time processing is a major advantage. Earlier versions sometimes had delays in updating information. IFMS 3.0 processes changes faster, so salary revisions, arrears, and updates reflect quickly in your account. You don’t have to wait days or weeks to see changes in your salary slip.

Integration with banking systems improved. Direct benefit transfer (DBT) happens more smoothly. Your salary credits to your account on time with fewer technical glitches. The system verifies bank account details more rigorously, reducing payment failures due to account number mismatches.

Mobile responsiveness got better in IFMS 3.0, though desktop usage still provides the best experience. The developers focused on making critical functions like salary slip download work smoothly on mobile devices. Future updates promise dedicated mobile applications for even better accessibility.

Migration from Old System – PayManager2 Raj Nic In Main Asp

If you’re transitioning from the older PayManager system to IFMS 3.0, your historical data migrates automatically. You don’t lose access to old salary slips or records. The login process remains similar, though you might need to reset your password during the first login on the new system.

Training materials and user guides are available on the portal. Video tutorials explain new features and navigation. If your department hasn’t conducted training sessions yet, reach out to your accounts section or IT cell for assistance. The transition period can be confusing, but support systems are in place to help.

Report any bugs or technical issues through the feedback mechanism on the portal. The development team actively works on fixes and improvements based on user feedback. Your input helps make the system better for everyone.

Step-by-Step PayManager2 Raj Nic In Main Asp Download Process

Let me walk you through the detailed <strong>paymanager2 raj nic in main asp download process for different types of documents. Understanding each step ensures you can access your information without assistance every time you need it.

For Salary Slips: Log in to the portal using your credentials. From the main menu, locate “Employee Corner” or “Employee Services.” Click on “Salary Slip” or “Monthly Salary Bill.” Select the financial year and specific month from dropdown menus. Click “View” or “Generate” button. The slip displays on screen. Click “Download PDF” or “Print” icon. Save the file to your preferred location.

For Salary Certificates: Navigate to “Certificates” or “Employee Reports” section. Choose “Salary Certificate” option. Some portals ask you to specify the purpose—select from available options or choose “Others.” The system generates a certificate with your current salary details and designation. Download the PDF file. This certificate is usually valid for three months from generation date.

For Bank Details Certificate: Access the “Reports” or “Certificates” menu. Select “Bank Details Certificate” or “Bank Account Details.” The certificate shows your bank name, branch, account number, and IFSC code as registered in the system. Download and use this for any official purpose requiring bank detail verification.

Downloading Historical Records

For older salary slips beyond a few months, the process is identical—just select the appropriate month and year. The system typically stores data for several years. If you can’t find very old records, they might be archived separately. Contact your office accounts section for slips older than five years.

Annual tax statements and Form 16 downloads happen through a separate section, usually labeled “Income Tax” or “Tax Documents.” These become available after the financial year ends, typically by June for the previous year. Download these promptly since server load is high during tax filing season.

GPF or NPS statements have their own download sections. Select the period for which you need the statement. Annual statements are most common, but some systems allow quarterly or monthly statement generation. These documents are crucial for tracking your retirement savings.

File Management Best Practices

Organize downloaded files systematically. Create folders by year, then subfolders by document type. This organization saves time when you need to find a specific document later. Cloud storage services like Google Drive offer unlimited storage for small PDF files and provide backup security.

Some people maintain a spreadsheet listing all downloaded documents with dates and purposes. This might seem excessive, but it’s helpful during audits, loan applications, or when compiling documentation for visa applications. A few minutes of organization saves hours of searching later.

Scan and digitize any physical salary documents you have from before the PayManager system. Keeping everything in one digital location—both old paper slips and new digital ones—creates a complete salary history. This comprehensive record proves invaluable during pension calculations or when resolving discrepancies.

Understanding Paymanager Salary Bill Structure

The paymanager salary bill is the comprehensive document that DDOs prepare for all employees under their charge. While individual employees see their personal salary slips, the salary bill contains aggregated information for the entire office or department. Understanding this structure helps if you’re involved in salary processing or want to understand the bigger picture.

Each salary bill has a unique identification number that includes codes for treasury, DDO, and the billing period. This identification system ensures bills don’t get duplicated or lost in processing. The bill header contains essential information—office name, DDO details, budget head, and payment month.

The main body lists all employees with their respective salary details. Columns typically include employee name, designation, basic pay, various allowances, gross salary, deductions, and net salary. The rightmost column shows the net payable amount. At the bottom, the bill shows totals for each column, giving the complete payout figure for that office.

Bill Approval and Processing Flow

After the DDO generates and submits the bill, it goes through multiple verification stages. The first check happens at the treasury level, where officials verify budget availability and mathematical accuracy. They ensure claimed amounts match sanctioned posts and pay scales.

If the bill passes initial scrutiny, it moves to the Accountant General’s office for detailed audit. Auditors check for compliance with pay rules, proper deduction of taxes and other statutory payments, and correct application of allowances. Any discrepancies lead to queries sent back to the DDO.

Once approved, the bill gets forwarded to the treasury for payment. The treasury initiates electronic funds transfer to individual employee bank accounts as listed in the bill. This entire process, from bill generation to salary credit, typically takes 5-7 working days when there are no issues.

Common Bill Processing Issues

Incorrect bank account details cause payment failures. When this happens, the amount gets held at the treasury. Employees need to submit corrected bank details through their DDO, who then files a revised bill. This delays salary receipt by several days or even weeks.

Budget overruns or exhaustion create another common problem. If the sanctioned budget for a particular head is insufficient for the month’s salary, the bill gets rejected. The DDO must then redistribute the burden across different budget heads or request additional budget allocation. This administrative work delays payments for all employees in that office.

Data mismatches between PayManager and service records cause audit objections. For example, if an employee’s service book shows a different joining date than PayManager records, the auditor raises a query. Resolving these requires producing service documents and getting corrections approved through proper channels.

PayManager2 Raj Nic In Main Asp: Portal Variations

You might encounter references to pripaymanager 2 raj nic in in your searches. This typically refers to variations or older versions of the PayManager portal. “Pri” might stand for “primary” or could be a typo of the main portal name. Understanding these variations helps you navigate if you’re directed to different URLs.

Different departments or treasuries sometimes use slightly different portal versions or URLs. The core functionality remains the same, but the interface might look different. All these versions connect to the central database, so your employee information is accessible regardless of which specific URL you use.

The Rajasthan government periodically updates domain names and server structures. If you’ve bookmarked an old URL, it might redirect to the new one, or you might get an error. Always verify you’re using the current official link. Check your office notices or the official Rajasthan government website for the correct URL.

Avoiding Phishing and Fake Sites

Be cautious about where you enter your login credentials. Scammers create fake websites that look similar to PayManager to steal usernames and passwords. Always check the URL carefully—it should end with “.nic.in” or “.rajasthan.gov.in” for genuine government sites.

Never click on links from emails or messages claiming to be from PayManager asking you to verify your account or update information. Government portals don’t send such emails. If you receive suspicious messages, report them to your IT department and delete them without clicking any links.

Bookmark the correct URL after verifying it’s legitimate. Always access the portal through your bookmark rather than searching Google each time. Search results sometimes show advertisements for fake sites before the genuine one. Your bookmark ensures you reach the right destination every time.

Regional and Departmental Variations

Some large departments maintain their own salary processing systems that integrate with PayManager. Teachers might use an education department specific portal for some functions while using PayManager for others. Similarly, police or health departments might have specialized interfaces.

These departmental portals pull data from the central PayManager database but present it in formats specific to that department’s needs. If your department has a specific portal, you’ll receive instructions during orientation. Use that departmental system for functions it handles and PayManager for everything else.

District-level variations exist where different collectors or treasury offices prefer specific procedures. The core system remains the same, but local practices for bill submission, query resolution, or document verification might differ. Follow your district’s established procedures while using the standard PayManager interface.

Final Thoughts on PayManager2 Raj Nic In Main Asp

Navigating <strong>paymanager2 raj nic in main asp becomes second nature once you understand the system. This portal isn’t just a salary slip generator—it’s your complete financial record as a government employee. From tracking your earnings and deductions to downloading certificates and managing your profile, everything happens here.

I’ve walked you through the essential aspects of PayManager, from basic login procedures to understanding complex features like IFMS 3.0 and salary bill generation. The key is familiarizing yourself with the interface and bookmarking important sections for quick access. Most employees only use 20% of the portal’s features regularly, but knowing what else is available helps when you need something specific.

Technology in government services keeps evolving. The PayManager system will continue getting updates and improvements. Stay informed about changes through your office circulars and department notices. Don’t hesitate to ask for help from your accounts section or IT cell when you’re stuck—they’re there to assist you.