Starting to Offer Alcoholic Beverages? What to Know About Liquor Liability Insurance:- When opening your pub or adding alcoholic beverages to your restaurant, you need liquor liability coverage. Most states require you to have this cover for your business. This insurance protects your business from potential damages, losses, and lawsuits from serving alcohol. Let’s explore liquor liability insurance, what it includes, and why you made need it for your liquor business:

Table of Contents

What Is Liquor Liability Insurance?

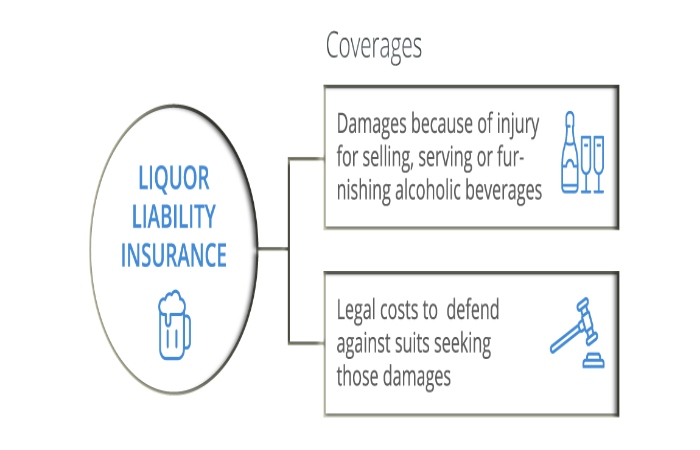

Liquor liability coverage is a commercial general liability policy that protects businesses that sell alcohol from claims and lawsuits. You will be covered if you over-serve someone who has had too much to drink or serves minors. You can get coverage if someone gets sick or injured while in your establishment.

Some states require liquor vendors to have liquor liability indemnity, but it’s optional for others. It’s always a good idea to purchase this type of coverage because it can help protect your business from costly issues. Hence, It covers claims for bodily injury, property damage, and legal defense costs if someone gets hurt after drinking your product.

Why Do You Need Liquor Liability Coverage? – Starting to Offer Alcoholic Beverages

If you’re starting up a bar, restaurant, or even liquor store, you’ll want to make sure you’re covered in case any guest gets injured while on your premises. Liquor liability indemnity covers the cost of defending yourself against lawsuits. It can help you pay out-of-pocket expenses should a customer be injured while on your property. Alcohol liability insurance is the best way to protect your business against these situations. This policy covers all legal claims made against you due to serving alcohol at your venue.

What Does Liquor Liability Insurance Cover?

Liquor liability assurance covers expenses related to the sale and consumption of alcoholic beverages, including:

• Claims of negligence or intentional injury caused by your employees serving alcohol to intoxicated patrons

• Medical expenses for people injured due to the consumption or use of alcohol at your establishment

• Property damage caused by intoxicated people

• Legal fees incurred in defending yourself against a lawsuit filed by someone injured while drinking at your place of business.

• Employees injuries or death

Limitations of Liquor Liability Insurance

Liquor liability insurance only covers certain types of incidents. It won’t cover any damages or injuries that occur away from your premises, such as at a barista’s home after a particularly long shift at the coffee shop. So, it won’t cover damages or injuries caused by other factors unrelated to the alcohol itself. However, Its liability indemnity doesn’t cover losses from intentional acts like assault, sexual harassment, or discrimination against customers. Moreover, it doesn’t cover injuries sustained from driving under the influence (DUI). It does not cover other types of lawsuits like those that arise from slip-and-fall accidents or defective products. The insurance doesn’t cover damage to property owned by the insured. This coverage is available through commercial general liability insurance.

The Cost of Liquor Liability Insurance

The regular liquor liability coverage cost might vary due to various factors, including the amount of liability coverage needed and the location where the business operates.

Other factors include:

• How much alcohol you serve

• The number of people that frequent your establishment

• Number of employees working at the establishment

• Whether or not there is live entertainment at your business

Where to Get Alcohol Liability Cover

A person can buy liquor liability coverage through an insurance agent or broker, or directly from an insurer. Some insurers specialize in this type of coverage, while others offer it as part of a larger CGL policy. Some carriers sell special policies designed just for restaurants and bars that serve alcohol on site.

Shop Around Before Selecting an Insurer

You should compare quotes from several insurers before settling on one particular policy. Insurance companies offer many different options for liquor liability coverage depending on the coverage you need and the risk your business presents. This will help you to get the best deal possible on this type of coverage. Hence, Take note of the different policies offered by each insurer to choose the one that suits your needs and budget constraints.

Ask Questions and Read the Fine Print

Before signing the policy, you need to ask what is covered. You should read the fine print carefully to understand the terms of the policy and its restrictions. So, You may want to consult with a lawyer before signing on the dotted line if there are any surprises later on down the road.

Extra Precautions to Take – Starting to Offer Alcoholic Beverages

To limit your liability and protect you need to take basic risk management procedures. You might display “drink responsibly” or “no minors allowed” banners. Hence, You can discourage underage drinking by posting signs stating that minors are not allowed in the establishment. If anyone underage is caught drinking on-premises, security guards should ask them to leave immediately.

Get Your Liquor Liability Insurance Today – Starting to Offer Alcoholic Beverages

Liquor liability indemnity is useful for any bar or restaurant that serves alcohol. To protect yourself from liability or future claims and legal, you need liquor liability insurance. Reach out to a reputable and reliable insurance agent or insurer. Insure your pub or restaurant and get peace of mind as you focus on growing your business.