Table of Contents

What is NSE?

nse: ucobank – National Stock Exchange is one of the world’s top largest exchanges and plays an essential role in operating India’s lucrative growth. It is a self-made label which has reached great heights. NSE is a social stock exchange website and stands for National Stock Exchange. It is basically at the country level and also spread to the international level. NSE is a trusted institution of market framework and has high grades of collaborated governance.

In 1994, NSE introduced electronic trading in India and also became the first exchange to operate screen-based trading. The NSE is a pioneer in technology trading and investments. It always aims to run a market environment that promotes efficiency and transparency. NSE’s strong and modern platforms provide good standards of security, safety, robustness and flexibility to all types and categories of investors for trading and also investment.

What is nse: ucobank?

The website NSE has provided information and the market summary of the UCO bank on its website. As of the 13th of April, the rate of nse: ucobank is 26.40 INR, and previously it was 25.25. It has increased by +1.15 (4.55%) difference. The other values are as follows:

Open – 25.30

High – 26.65

Low – 25.20

Close – 26.35

VWAP – 25.91

nse: ucobank also gives details like trade information, corporate information, pre-open market, intraday chart, historical data and glossary. All the information is categorized into these sub-headings.

What is ucobank?

nse: ucobank stands for United Commercial Bank and was founded in Kolkata, India. It is an Indian public sector bank that was established in 1943. Shri Soma Sankara Prasad is UCO bank’s MD & CEO. Shri Ishraq Ali Khan and Shri Rajendra Kumar Saboo are the executive directors. nse: ucobank has over 3000 service units spread throughout the entire country. Apart from this, they also control two international financial centres in Hong Kong and Singapore and have their agencies all across the world.

It is said to be one of the oldest banks in India and also was founded before the country’s independence. In 1969, it was nationalized by the Government of India and took 100% ownership. Then in 1985, the name United Commercial Bank was changed to UCO Bank due to an act of the Parliament. They served to be one of the vibrant and also old banks of India. Even if the name changed, their friendly customer service didn’t change.

Trade Information – nse: ucobank

This section in nse: ucobank offers all the information and details related to trade and trading. Let’s take a look at it!

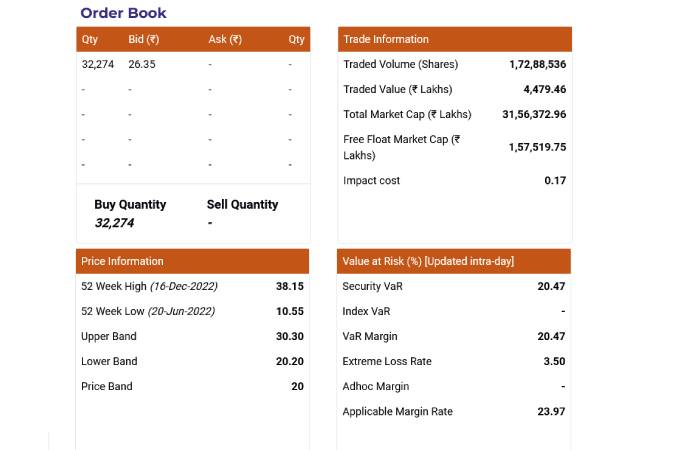

Order Book

It contains four tables which show the data of the order book. Table one shows the number of buys as 32,274 and the bid (in rupees) as 26.35. The second table talks about the trade information in which the traded volume (shares) is 1,72,88,536; traded value (in rupees lakhs) is 4,479.46; total market cap (in rupees lakhs) is 31,56,372.96; free float market cap (in rupees lakhs) is 1,57,519.75 and impact cost is 0.17.

In the third table, there is price information. Here, 52 Week High (as of 16-Dec-2022) is 38.15; 52 Week Low (as of 20-Jun-2022) is 10.55; Upper Band is 30.30, Lower Band is 20.20, and Price Band is 20. The fourth table shows the value at risk percentage. Here, Security VaR is 20.47, VaR Margin is 20.47, the Extreme Loss Rate is 3.50, and Applicable Margin Rate is 23.97. Following are more details in the order book section:

Series: EQ

Symbol: UCOBANK

ISIN: INE691A01018

Status: Listed

Date of Listing: 09-Oct-2003

Basic Industry: Public Sector Bank

Symbol P/E: 18.04

Sectoral Index P/E: 16.15

Sectoral Index: NIFTY BANK

Securities Information

Board Status: Main

Trading Status: Active

Trading Segment: Normal Market

SLB: Yes

Class of Shares: Equity

Derivatives: No

Face Value: 10

Issued Capital (Shares): 11,95,59,58,176

Industry Classification of nse: ucobank

Macro-Economic Sector: Financial Services

Sector: Financial Services

Industry: Banks

Basic Industry: Public Sector Bank

Conclusion

In conclusion, we have seen how the NSE has given such helpful information about the ucobank on its website. They have mentioned the entire market summary and also provided all the details that must be taken into consideration. We must inform you that the prices, rates and also values keep changing for a given period, so do not consider the above values as the latest ones. We hope you have found this guide on nse: ucobank helpful and also learned about the details of the ucobank. Thanks for reading!